Summary

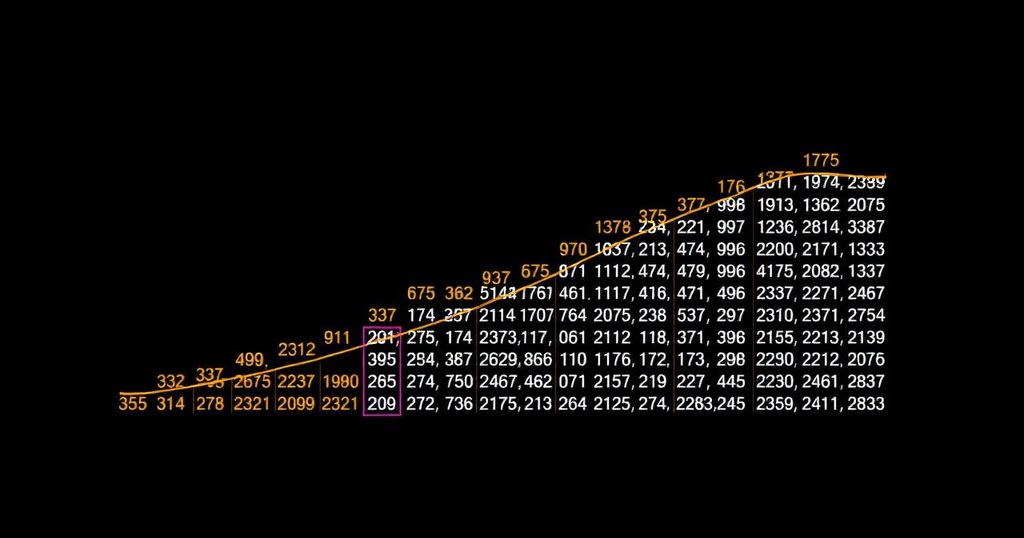

The Dow Jones Industrial Average, designed to represent 30 key companies that are foundational to the American economy, has increasingly come under scrutiny regarding the inclusion of Boeing (BA). Over the past five years, Boeing’s performance has not aligned with the expectations of a blue-chip company, leading analysts to question its continued presence on the index. Ron Epstein, a well-respected aerospace analyst with Bank of America, states unequivocally, “If you want bellwether, strong balance sheet companies, they don’t check those boxes any longer. I don’t think Boeing has to be there.” Historically, the Dow’s composition has evolved from its industrial roots at the end of the 19th century. Significant shifts in the economy have led to the departure of companies involved in traditional manufacturing sectors, replaced instead by firms focused on technology, finance, and pharmaceuticals. Thus, it would not be unprecedented for the Dow to eliminate the only remaining aircraft manufacturer, as prior removals have reflected shifts in the national economic landscape. Boeing continues to grapple with numerous challenges that further merit its exclusion. The company has not reported a profit since 2018, amassing a staggering core operating loss of $33.3 billion and facing expectations for continued financial strain. Following an incident involving an Alaska Airlines jet, Boeing has come under fire for alleged lapses in safety and quality, drawing federal scrutiny and multiple investigations. This has severely hindered its production capabilities, particularly concerning the critical 737 Max model. Moreover, Boeing’s financial health has diminished to the lowest tier of what is considered investment-grade credit, with indications it could soon slip into junk bond territory. This stark outlook is unprecedented among other companies listed in the Dow. In a further blow to its reputation, Boeing has pled guilty to charges of misleading the Federal Aviation Administration during the certification process of the 737 Max, relating to a design flaw that led to two tragic crashes, prompting even closer oversight from regulators. The implications are significant; Boeing’s stock has plummeted more than 60 percent since the second crash of the 737 Max. The persisting declines since the Alaska Airlines incident have decreased the Dow’s overall performance metrics, posing a relevant concern for investors. While Boeing has been a member of the Dow for 37 years, having been incorporated in 1916, historical longevity does not guarantee a permanent place. As Sam Stovall, chief investment strategist for CFRA Research, aptly notes, “The Dow tries to be as relevant as possible.” Other aerospace firms, such as Lockheed Martin and the newly rebranded GE Aerospace, stand out as suitable candidates to replace Boeing, demonstrating profitability and larger capitalizations. The Dow’s recent trend favors technology-oriented companies, as shown by the removal of ExxonMobil in favor of Salesforce in 2020, illustrating a shift towards companies that reflect evolving market dynamics. Despite its potential for longevity, the question remains whether Boeing still fulfills the criteria set forth for inclusion in such a prestigious index. While its future as a company might be secure, its position among the 30 companies representing the U.S. economy is uncertain. Ultimately, the continued debate about Boeing’s role within the Dow reflects broader questions about the composition of indices that serve as benchmarks for economic health.

Original Source: www.cnn.com

Leave a Reply